People all over the UK are starting to feel the winter financial freeze, so much so that some are even having to make the difficult decision to either turn the heating on or cook a meal, due to high heating costs.

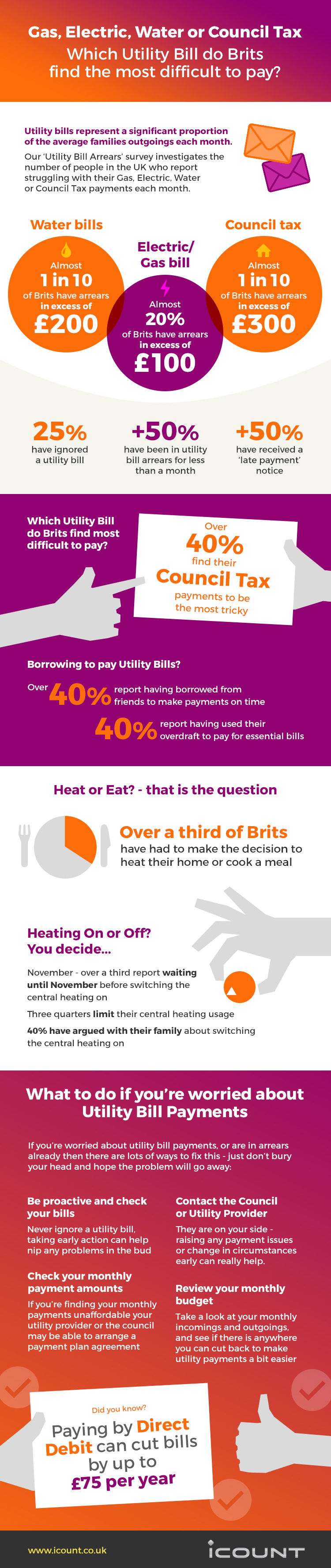

This startling statistic was recently uncovered in a survey by prepaid Mastercard providers and finance experts, icount. 25 percent of respondents admitted to ignoring a utility bill and shockingly, a third of Brits are waiting until as late as November to turn on their central heating. See the infographic below to discover the rest of the results from the survey.

To help, we’ve identified a few ways that you can manage your money better and enjoy the financial freedom this winter.

1. Timed heating and lighting

Investing in energy saving timers may sound like a small change, however, over time it can make a significant difference.

Light switch timers allow you to set which times your lights go on and off. This is not only energy efficient, but it also allows you to save on your electricity bills by turning your lights off when they’re no longer needed.

Central heating timers work along the same concept as light switch timers and many modern systems have this function fitted as standard. If not, you can invest in a central heating control that lets you schedule your heating to turn on when you need it.

2. Switch energy providers

If you find that year on year your heating and electricity bills are sky high, it may be worth researching other providers. This allows you to see what else is out there and see how much you could save.

As with any other product, you’ll need to do extensive research to ensure you’re getting the best deal. Websites like USwitch make this easier by allowing you to compare a number of different providers. Alternatively, you could go directly to the energy provider and potentially save even more money.

3. Rethink your budget

Are you spending more than you need on your weekly food shop? Could you be overspending on luxury goods? If so, then you may need to analyse your budget and see where you could save.

If you find yourself struggling to stick to a defined budget, you may benefit from a prepaid card such as the icount prepaid MasterCard and current account.

With the icount card, you can load money onto it and you can only spend what’s on the card. This means that you stick to a restricted amount and can avoid spending too much or going into your overdraft.